Partial year depreciation calculator

Chart showing details for sample asset. Multiply the amount of the monthly depreciation.

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

When you get to the depreciation section click Add Schedule E Pg 1 to.

. For example if you enter a Date in Service of July 1 2019 the TaxAct program. It is determined based on the depreciation system GDS or ADS used. So it gets difficult for businesses to determine how much depreciation expense they should report.

The depreciation calculator can also be used for calculating partial-year depreciation as well. The recovery period of property is the number of years over which you recover its cost or other basis. Assets are purchased and retired any time throughout the year.

Depreciation Method Asset Cost. Enter the rental income and expenses for the portion of the tax year the home was used as a rental property. This limit is reduced by the amount by which the cost of.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. When you get to the depreciation section click Add Schedule E Pg 1 to. The depreciation expense to complete the five year period would be calculated as 7 months in.

Based on the date you enter the TaxAct program will automatically calculate the current years depreciation. Calculate depreciation and create depreciation schedules. Section 179 deduction dollar limits.

Divide the total projected depreciation for the entire year by 12 to get the amount of monthly depreciation on the asset. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Includes online calculators for activity declining balance double declining balance straight line sum of years digits units of.

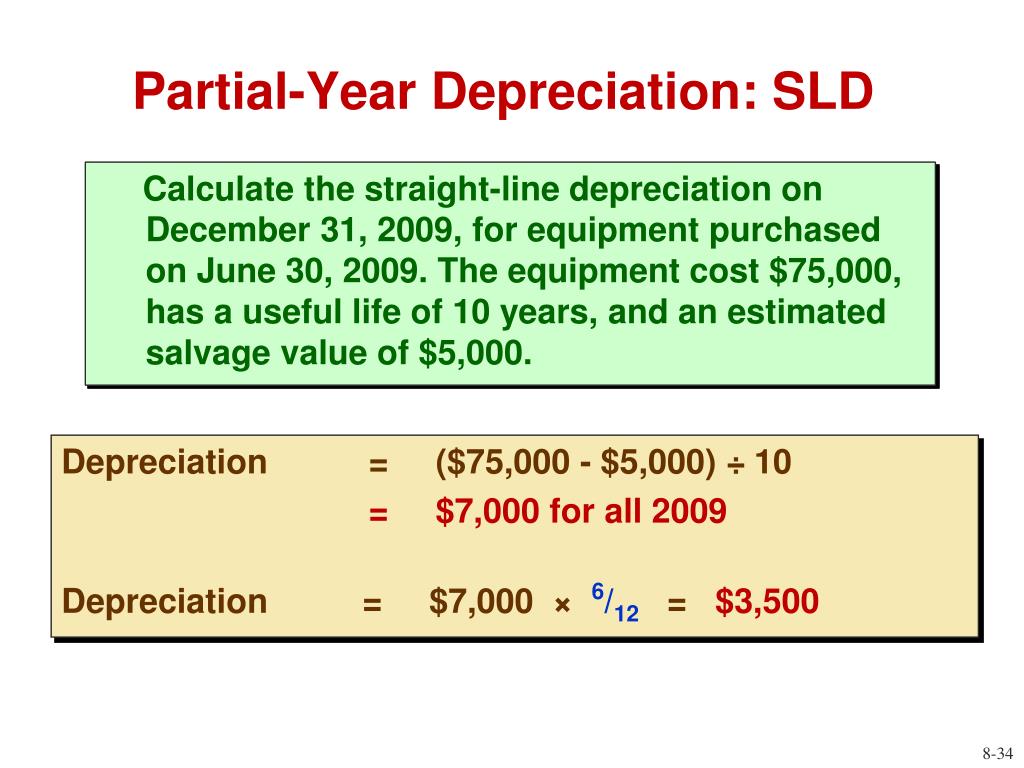

Partial-Year Depreciation Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of 43000 on October 1. So to get a clear picture a. Depreciationyear cost of asset- salvage value useful life eg.

The first years depreciation would be 733 x 5 3665. We need to define the cost salvage and. The MACRS Depreciation Calculator uses the following basic formula.

Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along. Enter the rental income and expenses for the portion of the tax year the home was used as a rental property. 1500 - 300 5 240year The Salvage value is the worth of an asset estimated at the end of its valuable life.

Based on this information you divide the 40000 the original value of the vehicle by ten years the life of the vehicle to calculate the per year depreciation of this vehicle.

Depreciation Accounting Sum Of Years Digits Method With Partial Period Allocation Youtube

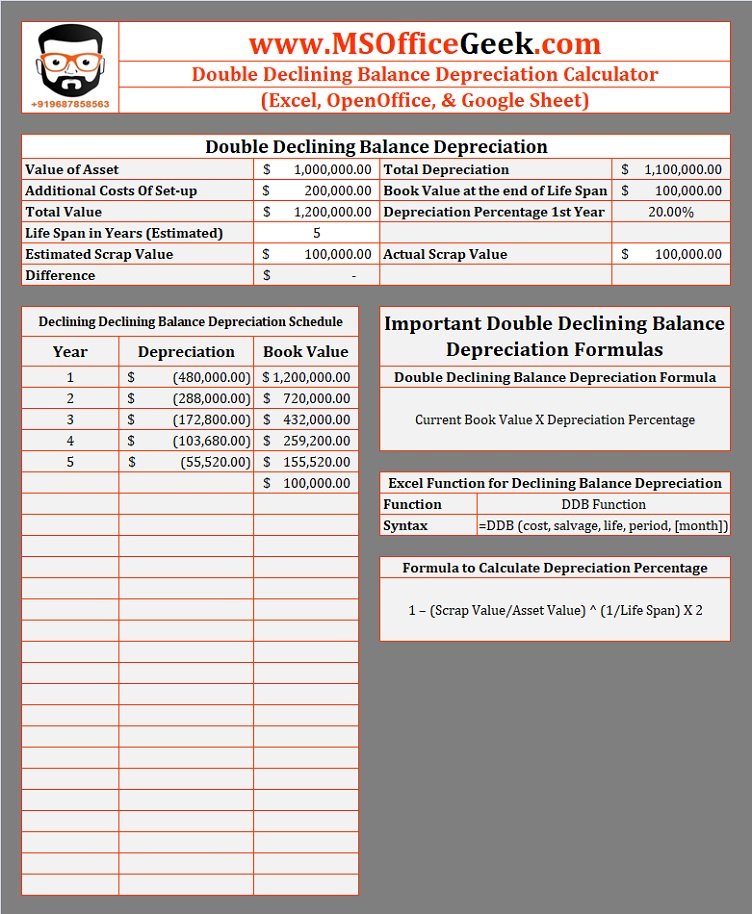

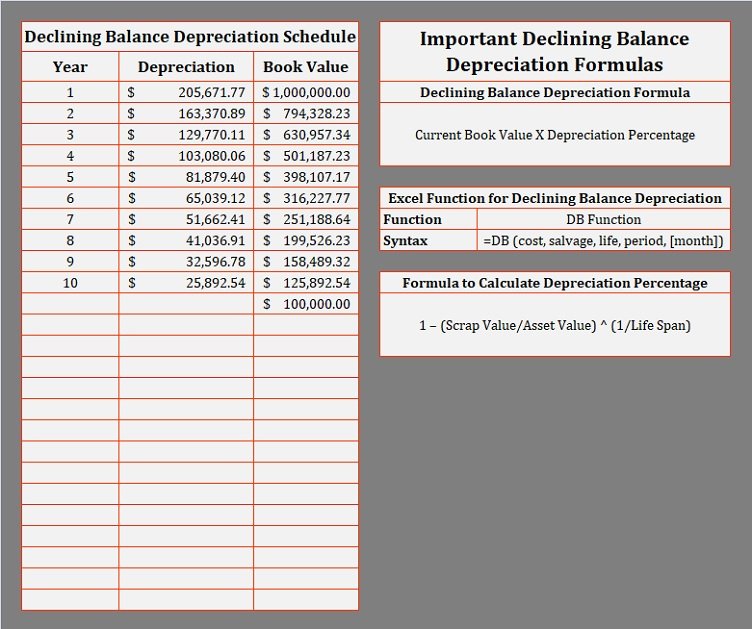

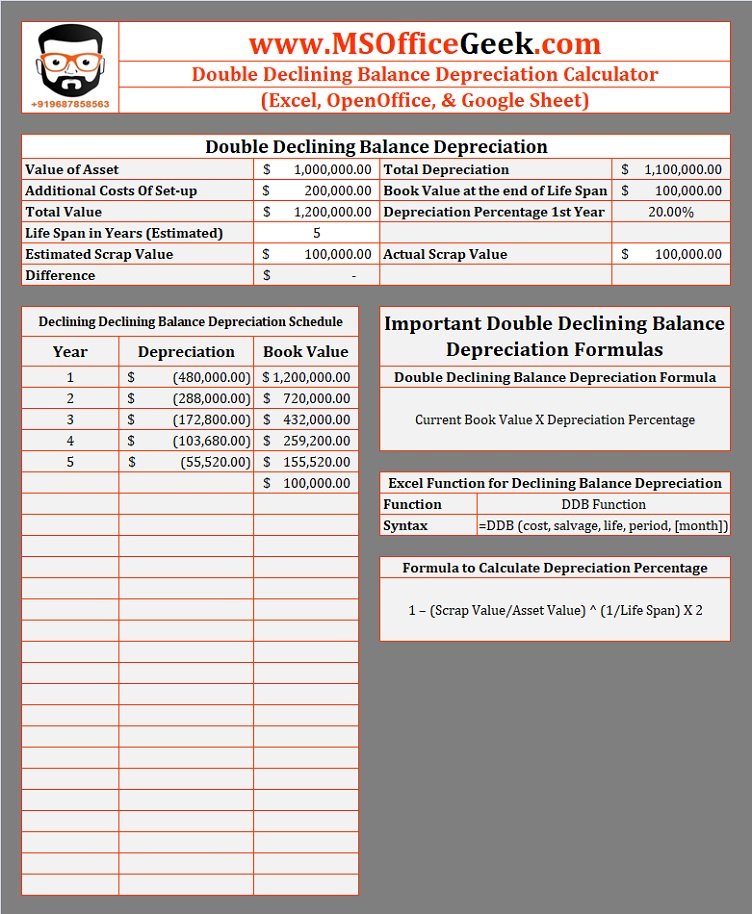

Declining Balance Depreciation Calculator Template Msofficegeek

Declining Balance Depreciation Calculator

How To Use The Excel Syd Function Exceljet

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Partial Year Depreciation Financial Accounting Youtube

Sum Of Years Depreciation Calculator Template Msofficegeek

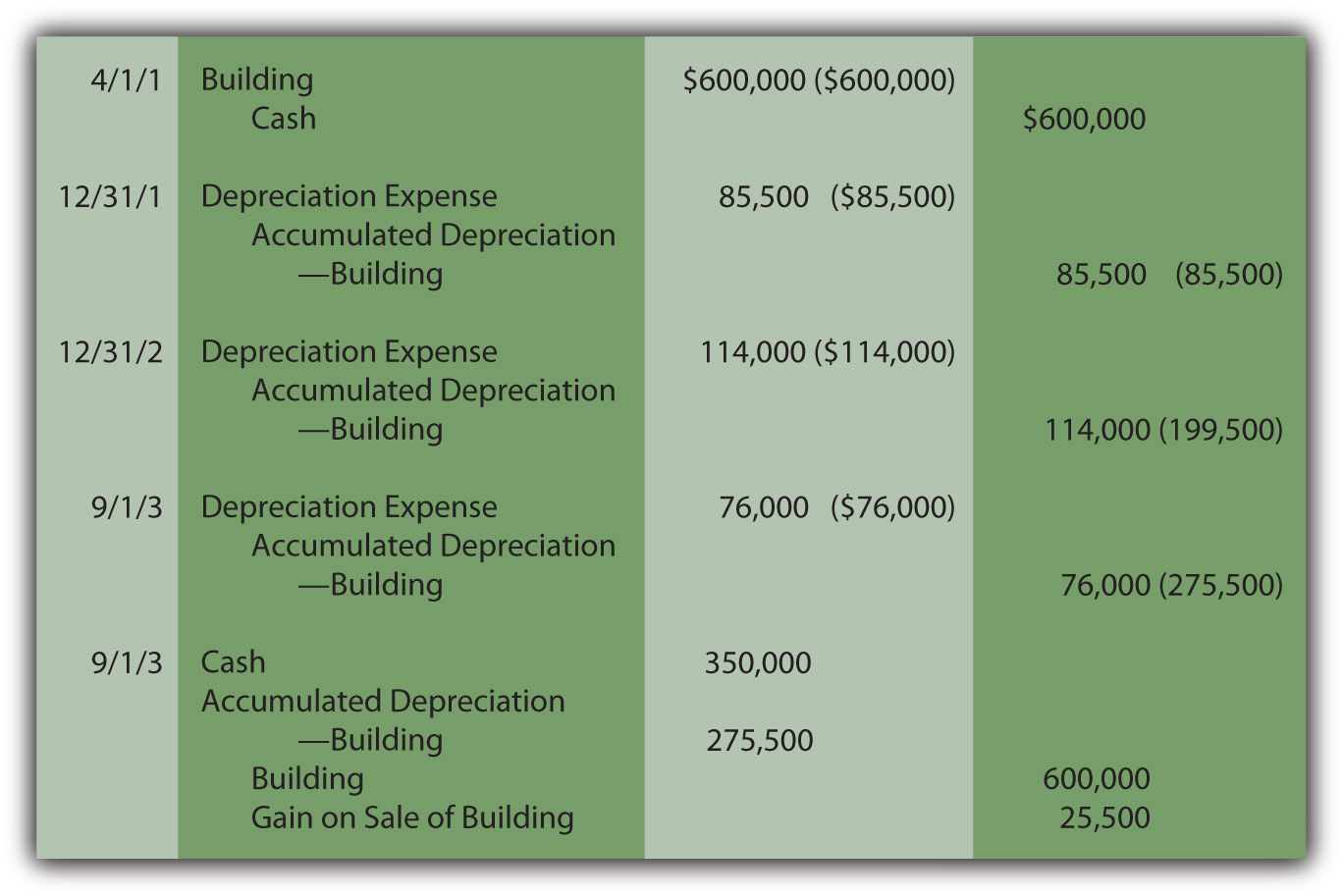

10 3 Recording Depreciation Expense For A Partial Year Financial Accounting

Practical Of Straight Line Depreciation In Excel 2020 Youtube

Long Term Assets Lecture 6 Partial Year Using Straight Line Depreciation Youtube

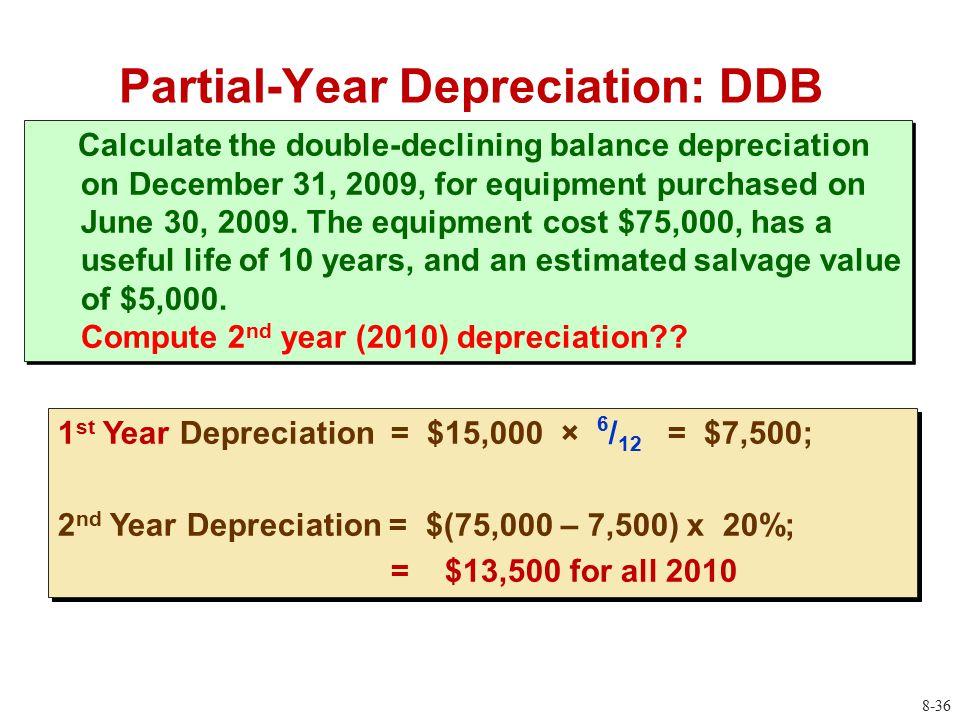

Chapter 8 Long Term Assets Ppt Download

6 7 Partial Year Depreciation Youtube

2

Declining Balance Depreciation Calculator Template Msofficegeek

Ppt Chapter 8 Powerpoint Presentation Free Download Id 262896

Declining Balance Depreciation Calculator Template Msofficegeek

Partial Year Double Declining Balance Depreciation Youtube